us japan tax treaty withholding rate

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. 30 rather than 15.

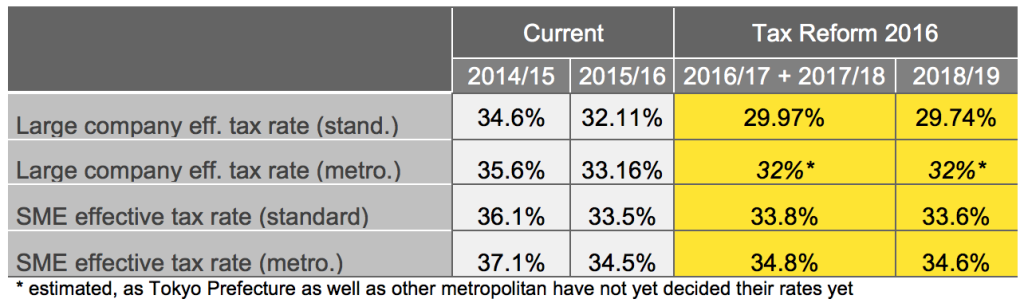

Japan Tax Reform 2016 Japan Industry News

Dividend withholding tax on all dividends received from US.

. Applicability of the agreement. Here is an overview of US tax treaties with other countries. Argentina and the United States of America Limited double tax treaty.

30 10 30 Note there are certain exemptions that may apply Austria Last reviewed 11 January 2022 Resident. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. The foreign tax treaty also applies if you worked in the US.

The MIT withholding rate on income attributable to a trading business amounts from certain cross-staple arrangements and rents from agricultural land and certain residential housing is set at a rate equal to the top corporate tax rate ie. 0 0 0 Note that a rate of 49 applies in the case of interest and certain dividends where a Tax File Number is not quoted to the payer. If your country and the United States have an income tax treaty in place then the tax tool in AdSense will identify.

A Form W-8EXP is used by entities to establish non-US beneficial owner status and eligibility for a reduced rate of tax withholding as a non-US government central bank. India and USA subject to certain exceptions. The DTAA applies to the residents of the contracting states ie.

It Was Ratified by the President of the United States on. 0 or 275 0 or 25 or 275 0. 3 The Internal Revenue Code of 1986 as amended.

Withholding tax on actual distributions made to a foreign partner. In addition you also need to check if you have tax obligations in the country you earned your income or resided during 2021. Summary of US tax treaty benefits.

This means for every 100 dividend you get from stocks or investments in the US markets only 70 reaches. Income tax regulations between two countries are documented in tax treaties. As an example a treaty may provide that interest earned by a nonresident eligible for benefits under the treaty is taxed at no more than five percent 5.

0 or 275 0 0 or 20. Stocks ETFs bonds mutual funds etc because Singapore doesnt currently have a tax treaty with the US. For residents of non-EEOI regulated countries a final WHT at a 30 rate applies.

Tax treatyformally known as the Convention between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and on Capital Gainsalso addresses. A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on March 8 1971. Singapore investors are subjected to a 30 US.

If a PTP has effectively connected taxable income for any year and any portion of such income is allocable to a foreign partner the PTP must collect a US. Treasury Regulation Section 11446-4e. Ratification Was Advised by The Senate of The United States on November 29 1971.

Rate of withholding tax Interest. Individual Number nicknamed My Number. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax.

However local law in some cases may provide a lower rate of tax irrespective of the. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. By providing credit to the extent of tax already paid in the US The tax paid by Mr X in the US will be eligible for deduction in India.

The DTAA applies to the following taxes. Tax treaties usually specify the same maximum rate of tax that may be imposed on some types of income.

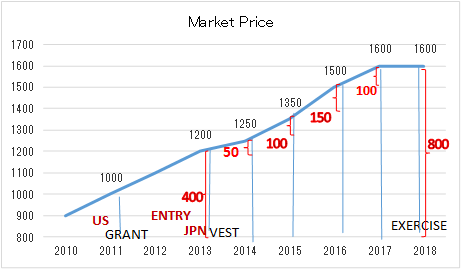

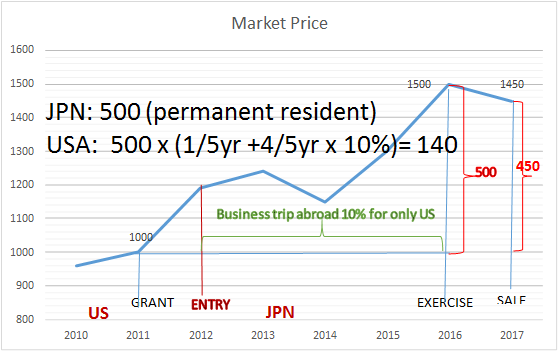

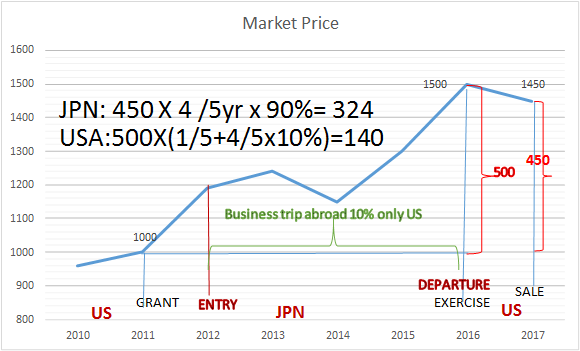

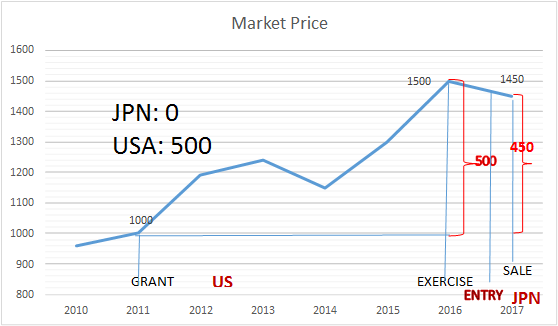

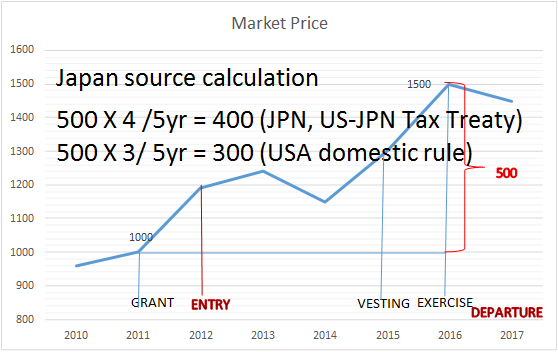

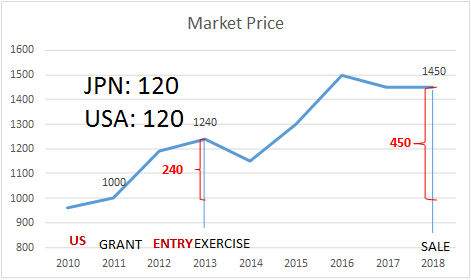

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

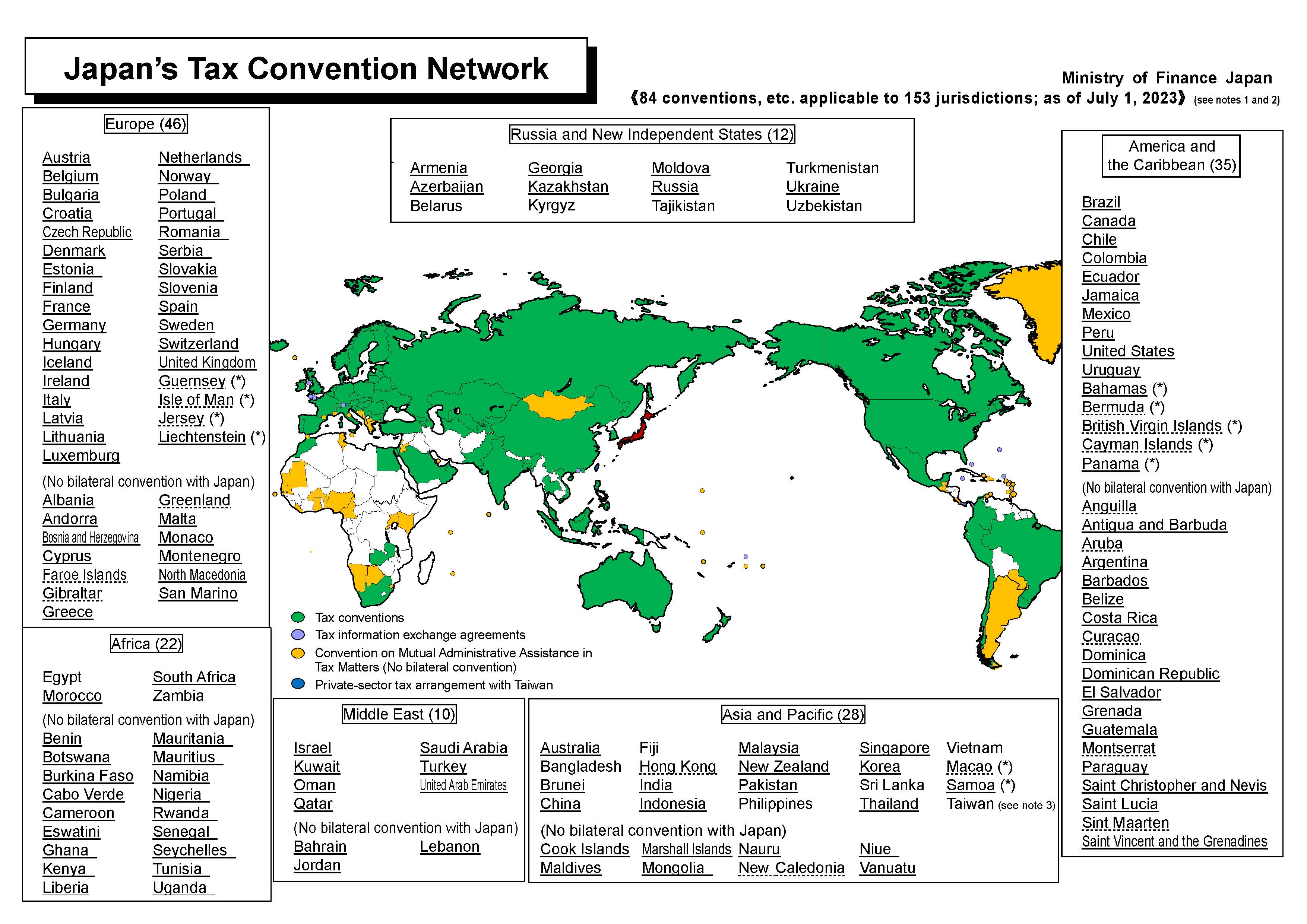

Japan S Tax Convention Network Ministry Of Finance

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

What Every Foreigner Working In Japan Should Know About Resident Tax Tsunagu Local

Us Expat Taxes For Americans Living In Japan Bright Tax

![]()

Individual Income Tax In Japan Business In Japan Sme Japan

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Japan United States International Income Tax Treaty Explained

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

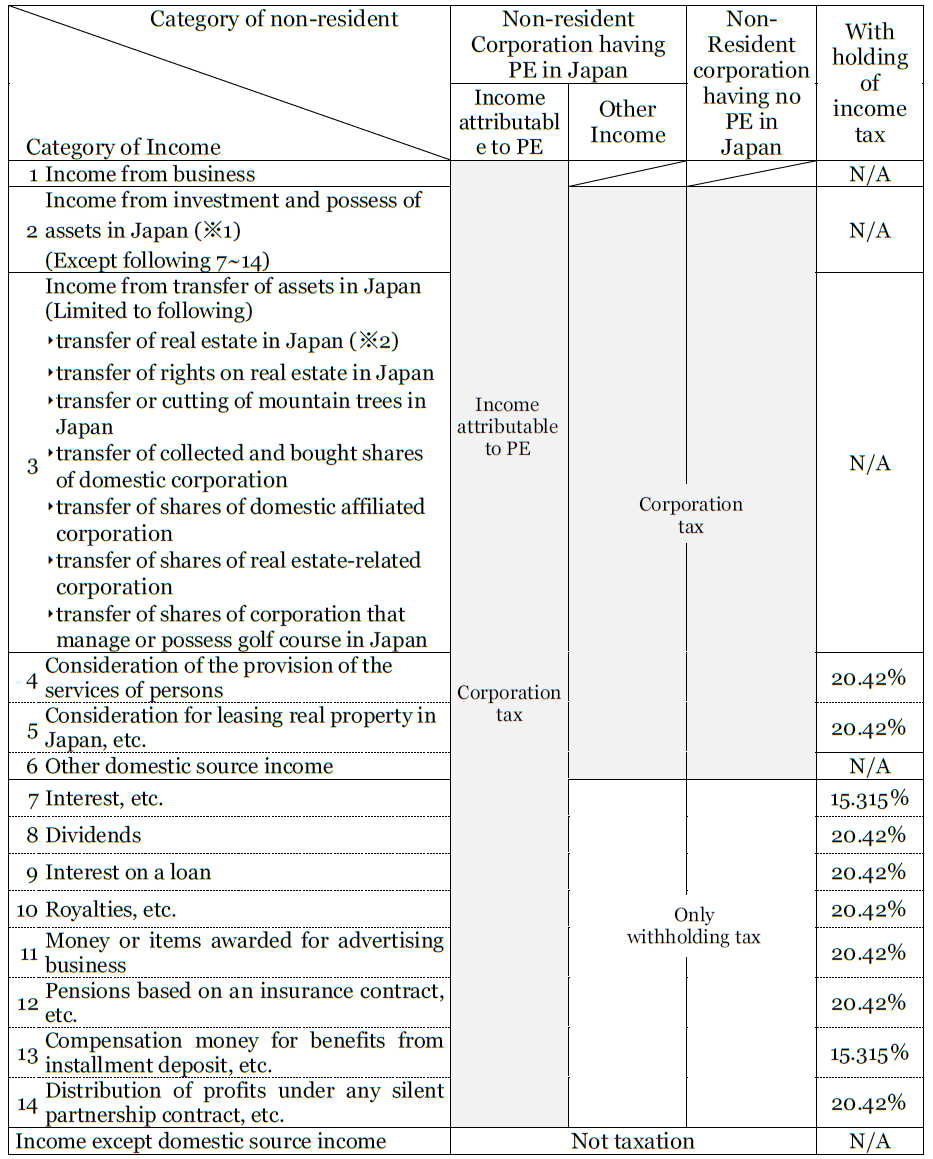

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Withholding Tax For The Leasing Of Real Estate Owned By Non Residents Plaza Homes